Teak forests in Ecuador: Make your investments grow strong

Our shares are listed in the Stock Market

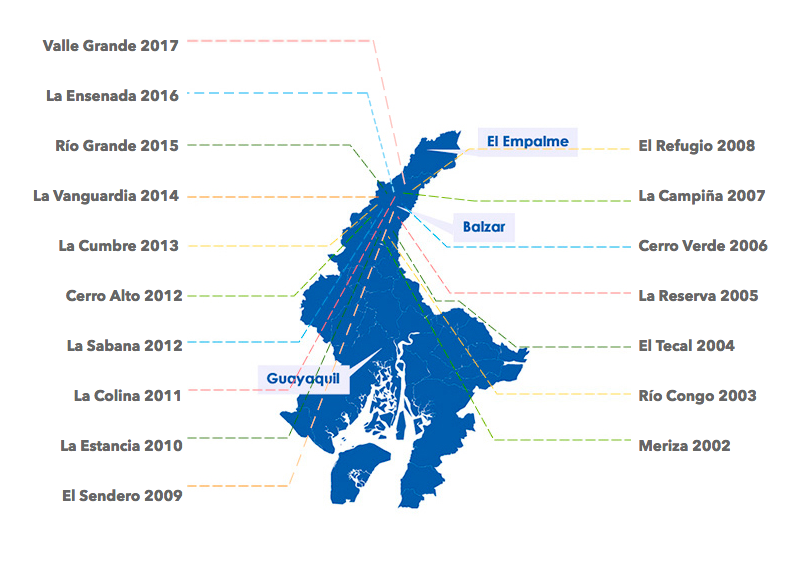

Since 2002, our team of experts has planted and managed 17 teak plantations that are listed in the Stock Market.

High annual profitability projection

It is calculated based on production volume, expenses projection and estimation of inflation in the price of wood in the international market.

Multiple sprouts, multiple dividends

The investor is the beneficiary of the dividends of the first cut, and of the dividends of the subsequent cuts,produced by the sprouts of the previous teak trees.

Affordable investment amounts

Our minimum investment amount of $ 2,600 makes our shares an affordable option to invest and save money.

Our teak plantations

Since 2002, we have planted 17 teak forests in Ecuador. They are located between El Empalme and Balzar, located north of the province of Guayas.

The climate of the sector allows a successful crop, with an excellent level of rainfall. All the plantations have natural drainages and easy access roads.

Read what our investors think about SIEMBRA:

Are you looking for a profitable business in Ecuador to invest?

Ecologic Calculator

**The calculation of the Carbon Fixation is based on the carbon fixation projections of a teak plantation along 20-year cut rotations. Due to conservative effects, successive cuts are not taken, even considering that teak is a species of sustainable management since the regrowth is cut every 12 years after the first cut.